Bank with Moola

Recieve, send and save smarter, All your transactions in one place

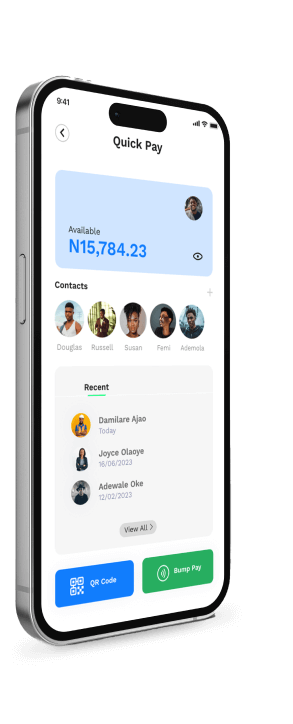

Experience easy & fast transfers when you make and receive payments with your Moola.

Experience easy & fast transfers when you make and receive payments with your Moola.

Pay all your bills in one place.

You are in safe and smart hands

We are fully licensed by the Central Bank of Nigeria and insured by NDIC

Frequently asked questions

What is Moola?

How do I sign up for Moola?

Is my money safe with Moola?

What features does Moola offer?

How can I contact customer support?

What our customer says

Don't just take our word for it, see what actual users of our service have to say about their experience.

Ali Barma

consultant

Excellent experience with Moola! The user-interface made managing my finances a breeze. The quick and secure transactions gave me peace of mind, and their customer support team was incredibly responsive and helpful.

faruk hammed

IT professional

I absolutely love the bank because of fast and seamless transaction. The quick and efficient account setup process was impressive, Kudos to the team for creating such an innovative and reliable banking platform.

bity ayuk

administrative support

I just want to share my fantastic experience with Moola, they have helpful customer services. The seamless transaction feature is very commendable.